Home sellers who are hoping to sell this year should get their ducks in a row, because the best time to list a home in 2025 is approaching quickly.

The week of April 13-19 is expected to have the ideal balance of housing market conditions that favor home sellers, more so than any other week in the year. A recent survey from Realtor.com® found that the majority (53%) of home sellers took one month or less to get their home ready to list, so the time to start prepping is now.

This selection comes from looking at seasonal trends from 2018-2024 data (excluding 2020), and calculating a Best Time to Sell score for each week of the year, based on a combination of housing metrics. Notably, mortgage rates are not included in the score as mortgage rate movement has more to do with the larger economic context, and does not follow a seasonal pattern.

We expect the 2025 housing market to behave according to typical seasonality, but offer slightly better conditions than 2024. Each week was scored based on favorability toward sellers — this included competition from other sellers (active listings and new listings), listing prices, market pace (days on market), likelihood of price reductions, and homebuyer demand (views per property on Realtor.com). Percentile levels for each week were calculated along each metric, and were then averaged together across metrics to determine a Best Time to Sell score for each week. Rankings for each week were based on these Best Time to Sell scores.

2024 brought another challenging year for the housing market, with stubbornly-high housing costs. Except for a period in the early fall, mortgage rates remained in the high-6% to low-7% range through 2024. September 2024 brought a recent mortgage rate low of 6.08%, but rates surpassed 6.5% once again by mid-October, and have since hovered between 6.5% and 7.0%. Home listing prices peaked for the year at a median of $439,900 nationally in June 2024, falling short of the previous year as well as 2022’s all-time high. Prices generally hovered just below year-ago levels in 2024. Though the slight price improvement was welcomed, it did not move the needle much in terms of affordability. Furthermore, home sales prices moved in the opposite direction, with the median home sale price hitting a new high in June 2024, highlighting diverging trends in what’s for sale–smaller, lower-priced homes–and what is selling–larger, higher-priced homes.

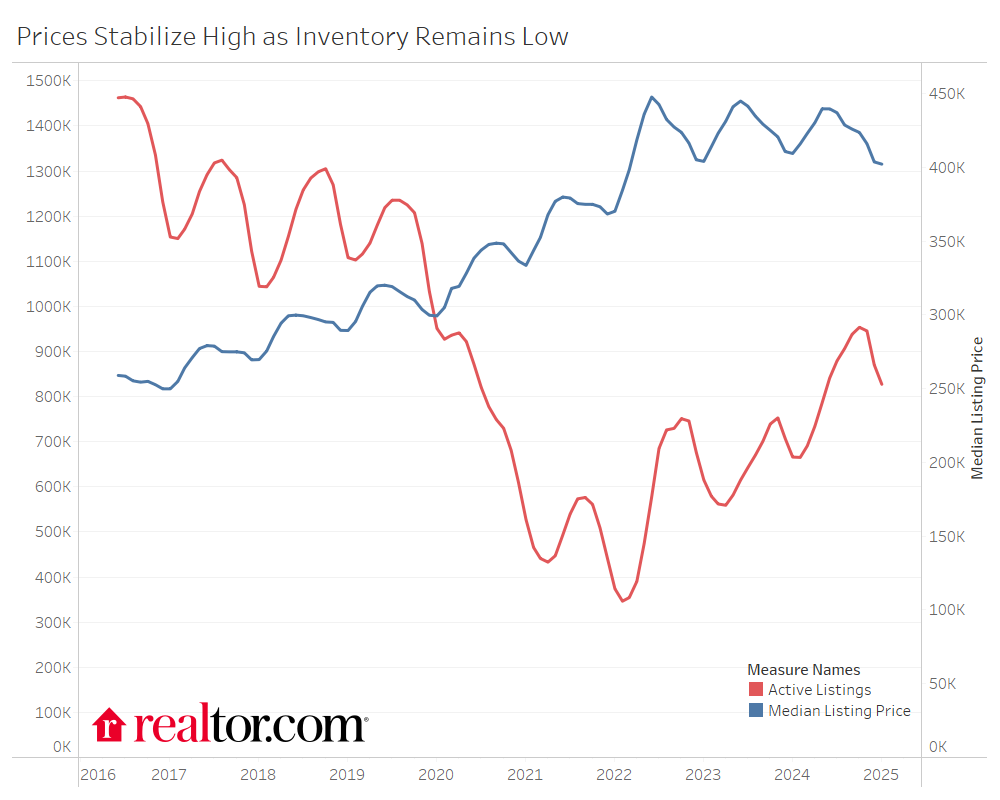

One bright spot in the 2024 housing market, however, was inventory levels. There were more homes for sale in 2024 than in any year since the onset of the pandemic. Home prices remained high, but buyers in many markets saw more for-sale options, a slower market pace and perhaps even more flexible sellers.

Many homeowners have felt ‘locked-in’ by their mortgage over the last few years, but some of the effect seems to have slackened in 2024, resulting in higher inventory levels. Despite recent improvement, inventory remains more than 20% below pre-pandemic levels, making it a good time to be a seller in today’s market. Continued mortgage rate improvement that will bring market mortgage rates closer to rates owners pay on outstanding mortgage debt will help unlock more potential sellers over time. Meanwhile, new construction provides additional home inventory. Both factors will be important in returning inventory to pre-pandemic levels.

Benefits of Listing April 13-19, 2025

At a national level, this week represents a balanced selection of market conditions that favor sellers. By balancing prices, inventory, demand and market pace, sellers are expected to have a better-than-average selling experience by taking advantage of the best week. While affordability will continue to be a challenge, we expect lower mortgage rates and more inventory to inject some life back into the market.

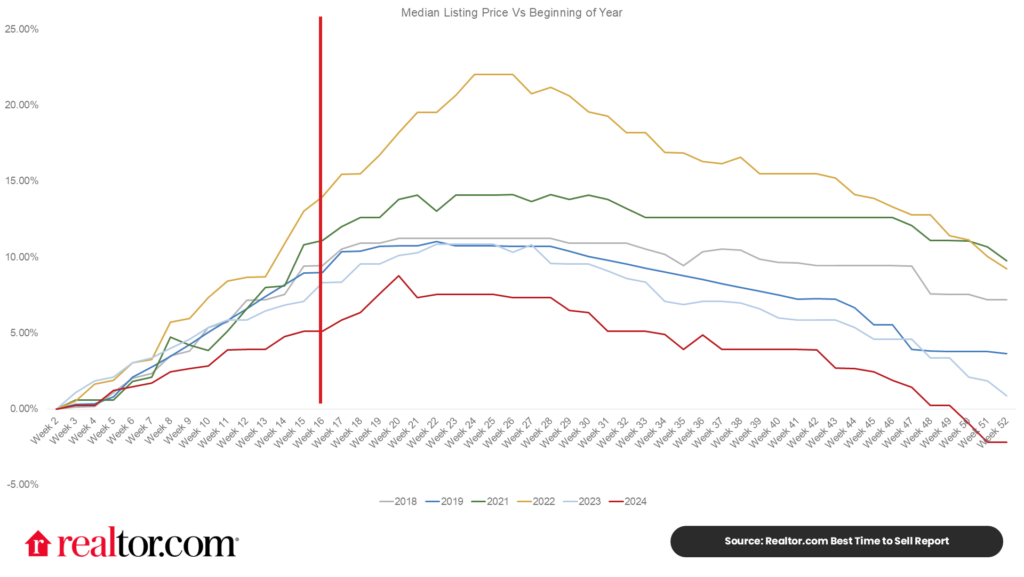

Above-average prices– Homes during this week have historically reached prices 1.1% higher than the average week throughout the year, and are typically 6.7% higher than the start of the year. This year is likely to look a lot like 2023 and 2024 due to still-high housing costs. If 2025 follows the previous years’ seasonal trends, the national median listing price could reach $4,800 above the average week, and $27,000 more than the start of the year.

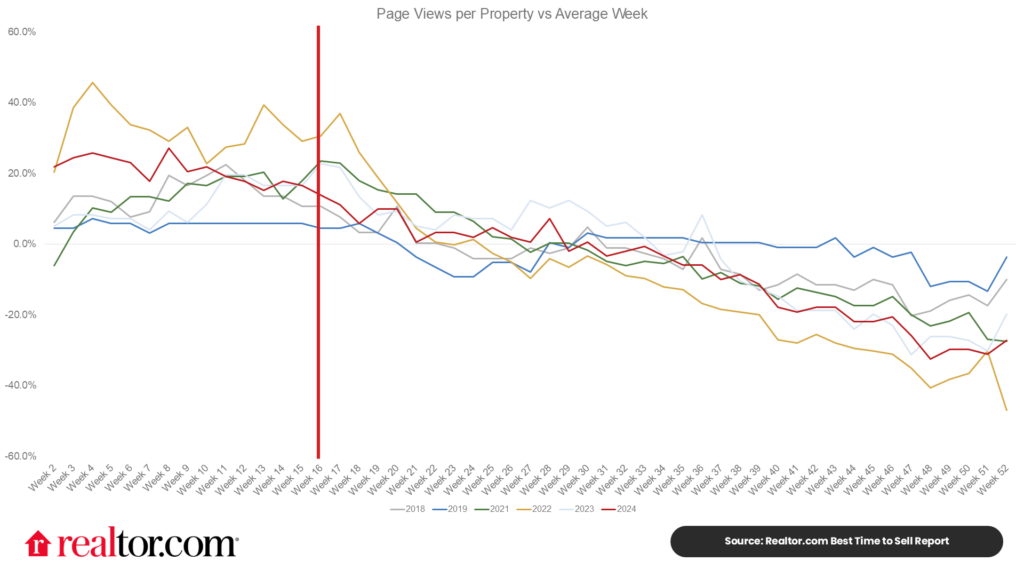

Above-average buyer demand – The number of buyers browsing a listing can determine how many offers a home gets and how quickly it sells. The more buyers looking at a home, the better for the seller, and in most years buyers start earlier than sellers. Historically, this week garnered 17.7% more views per listing than the typical week. Mortgage rates have remained higher than 6% for more than two years, and in response, many buyers have stayed out of the market. After two years of high rates, however, it is likely that buyers will trickle into the market this spring, enticed by improved inventory and slowing price growth across much of the country. If mortgage rates also fall this spring, it is possible that demand will surge sooner and with more vigor.

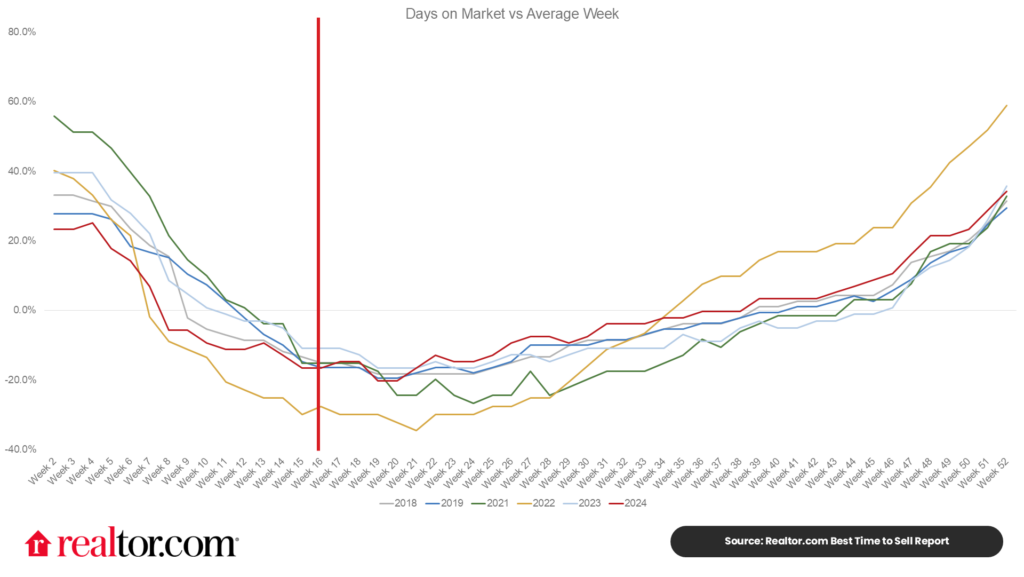

Quicker market pace – Thanks to above-average demand, homes sell more quickly during this week. Historically, homes actively for sale during this week sold 17.0%, or roughly 9 days, faster than the average week. In the 2024 market, this week saw homes typically on the market for 46 days, 5 days faster than the year’s average, and 7 days faster than was typical in 2019. Market pace did not differ greatly from the previous year in 2024 as the opposing forces of low inventory and low buyer demand resulted in little change. If buyer demand picks up more quickly than inventory this spring, market pace could quicken as buyers vie for fewer homes.

Lower competition from other sellers – A typical inventory trend would mean 13.2% fewer sellers on the market during this week compared to the average week throughout the year. Seller activity tends to climb from the beginning of the year until roughly November. In 2024, for-sale inventory reached its highest level since 2019, but remained below the pre-pandemic norm. Inventory gains continued into 2025, with the number of homes for sale up 24.6% compared to the previous year in January, but was still down 24.8% compared to pre-pandemic. This gap means there continue to be opportunities for sellers who enter the market this spring.

Below-average price reductions – Price reductions tend to peak in the fall as sellers left on the market after the summer rush try to attract attention. The late winter and spring bring the year’s lowest level of price reductions as buyer activity ramps up. During the Best Week, roughly 20.9% fewer homes have had a price reduction than the average week of the year, which translates to a 0.7 percentage point lower price reduced share compared to the average week of the year.

Last but not least, and you're the only one who can answer this: How badly do you want the home?

Maybe you’ve been house-hunting for a while now, and you’ve finally found what you think is the perfect home for you. This property meets your needs and the asking price is well within your budget. It might be worth it to consider offering exactly what the seller is asking for, or even a bit more—an offer that the seller can’t refuse, to show that you’re a serious buyer and you want the property more than anything else.

Economic Uncertainty and Shifting Market Dynamics

In 2024, home sales fell slightly from 2023’s nearly three-decade low as challenging affordability conditions kept buyers sidelined. However, seller activity climbed through 2024 as the lock-in effect eased and homeowners increasingly chose to get into the market. Inventory levels were fortified by slow buyer activity, leading to climbing time on market.

However, heading into 2025’s selling season, conditions look a bit rosier. More for-sale options can stoke buyer demand in both well-supplied markets and in in-demand markets with low inventory levels. This year’s housing market will hinge on improved affordability conditions, which will be highly dependent on falling mortgage rates and climbing inventory. Additionally, it is unclear how the current administration’s plans will impact the U.S. economy and housing market, which may make some households hesitant to make any big financial decisions.

Mortgage rates are expected to move to the mid-to-low 6% range by year’s end. In 2024, mortgage rates did not exceed their fall 2023 peak, but neither did they ease significantly. Altogether, buyers have faced nearly 2.5 years of 6%+ mortgage rates, and so far in 2025, rates have hovered near 7%. We do expect mortgage rates to ease this year as inflation gets closer to the 2% target level, but deviations from this trend, as we saw in some of the early-year data, will create bumps in mortgage rates and proverbial bumps in the road for homebuyers. While inflation and employment data are key inputs to the Federal Open Market Committee’s upcoming rate decisions, we’ve seen that policy announcements can move rates, too. Mortgage rates are expected to trend lower. Even so, sellers and buyers would be wise to rate-proof their budgets by planning their reactions to a sudden uptick or easing of rates.

Prices tend to peak later, as does competition. Sellers should consider that peak prices later in the season also come with greater competition from other sellers for a similar-sized pool of buyers. Historically, by the end of June, while prices reached near-peak levels (+7.6% in 2024) compared to the start of the year, new sellers also surged, increasing to nearly 1.5 times higher than at the start of the year (+46.2%). More sellers in the market is great for buyers, but less stellar for other sellers. Homeowners hoping to sell this year can mitigate that risk by getting into the market early, raising their already high odds of a successful close and likely negotiating favorable terms.

Uncertainty Could Factor into Buyer and Seller Confidence – Though inflation has eased over the last few months, the path forward is not certain given the current administration’s various economic priorities and proposals. Specifically, tariffs could make homebuilding far more expensive in the U.S., and could hurt the housing market both via higher inflation (which keeps mortgage rates high) and by limiting homebuilding activity. On the other hand, the administration has signaled their intent to address housing affordability, which could benefit the market. It is too soon to tell how these proposals will play out, and it’s important to acknowledge that individual perspectives can influence whether policies create more or less enthusiasm, but buyers and sellers may be hesitant to make any big moves until the future is a bit more clear.

What does this mean for sellers?

While we’ve identified April 13-19 as the best week to list for sellers, the housing market remains undersupplied, so a seller listing a well-priced, move-in ready home is likely to find success. Because spring is generally the high season for real estate activity and buyers are more plentiful earlier rather than later in the year, listing earlier in the spring raises a seller’s odds of a successful sale. Sellers will want to remember that it’s a process and get started well before their intended listing date.

What does this mean for home buyers?

Over the last year, buyers have seen market conditions improve. There are more homes for sale than in the last few years, which means the market pace is a bit more manageable–with longer days on market–and many sellers are more flexible–as shown in higher shares of homes with price reductions. This means that though buyers face still-high housing costs, they may find a bit more give in the market, which could give them more time to make a decision, even in the busy spring and summer months.

Historically, the number of views per listing has cooled in the late summer/early fall and tends to improve for buyers from that point forward. In 2024, the number of sellers with actively-listed homes increased by more than 30% compared to the beginning of the year in the fall, which means more options for buyers. Thus, buyers who can persist in their home searches are likely to catch a bit of a break in the sense that they can expect some more options to choose from in the weeks ahead.

by Hannah Jones

![Your Home Buyer Wants To Extend The Closing Date—What Now? [PART 2]](https://images.squarespace-cdn.com/content/v1/596d73999f74561878f1d37a/1764096549713-0WWC7CZ4IGVOBGLO53XC/banner.jpg?format=200w)